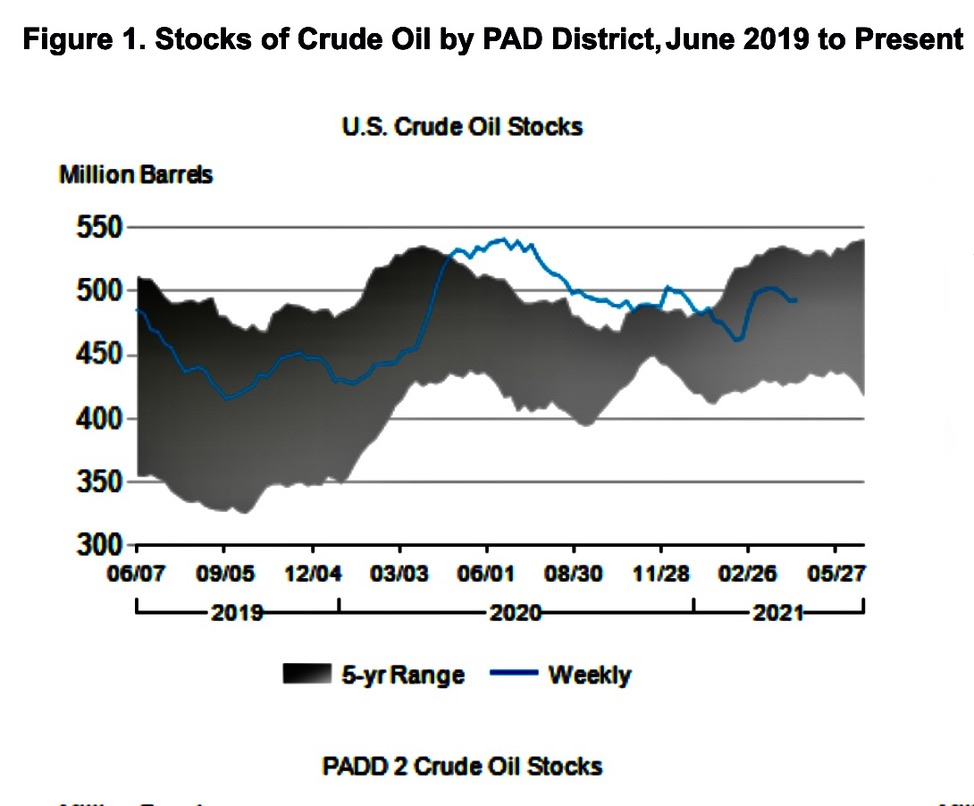

Oil and gas inventories increased only slightly last week, making the figures a non-factor in information that usually offers a glimpse of the health of the economy. However, analysts told Zenger News the figures confirm that a recent resurgence in coronavirus cases is proving to be a major drag on the global energy market.

The U.S. Energy Information Administration, part of the Energy Department, said that total commercial crude oil inventories increased by about 600,000 barrels during the week ending April 16.

Waxing and waning inventory levels are usually indicative of demand in the economy. The modest build on crude oil inventories suggests overall economic activity has been relatively static.

“The report was neutral, with overall petroleum inventories slightly increasing versus the previous week,” Giovanni Staunovo, a commodities analyst at Swiss investment bank UBS, told Zenger.

However, there was a positive element on the refined petroleum product side. The total amount of gasoline supplied to the market, a proxy for demand, was reported at 8.9 million barrels per day for the four-week moving average. That’s a nearly 62-percent improvement over year-ago levels, and according to Staunovo, is pretty close to pre-pandemic levels.

That was offset by total commercial gasoline inventories increasing during the week ending April 16 by about 100,000 barrels, suggesting near-term demand for fuel was a bit sluggish. That’s not much of a surprise, given the lull that’s typical between the Easter holiday and Memorial Day, the unofficial start to the summer travel season.

Phil Flynn, an energy market analyst at The PRICE Futures Group in Chicago, told Zenger the product-supplied indicator was a welcome sign, albeit a modest one, but refinery activity was a bit lower than usual, suggesting the market is not yet firing on all cylinders.

Crude oil prices fell sharply in Wednesday trading.

West Texas Intermediate, the U.S. benchmark for the price of oil, was down about 2.5 percent midway through the session to trade near $61 per barrel, down from the early March peak of around $66 per barrel.

Ole Hanson, the head of commodities strategy at Saxo Bank in Denmark, told Zenger that the difficulty in handling the pandemic in major economies such as Europe and Asia have darkened the mood. But even though they were slight, there were positive signals for the market in the latest federal energy report.

“On balance, it was a slight bullish report, which however may not be enough to sway the overall focus away from surging virus cases in the important Asia region,” he said.

(Edited by Bryan Wilkes and Alex Willemyns, Visuals edited by Claire Swift)

The post Virus Fears Loom Over The Oil Market appeared first on Zenger News.