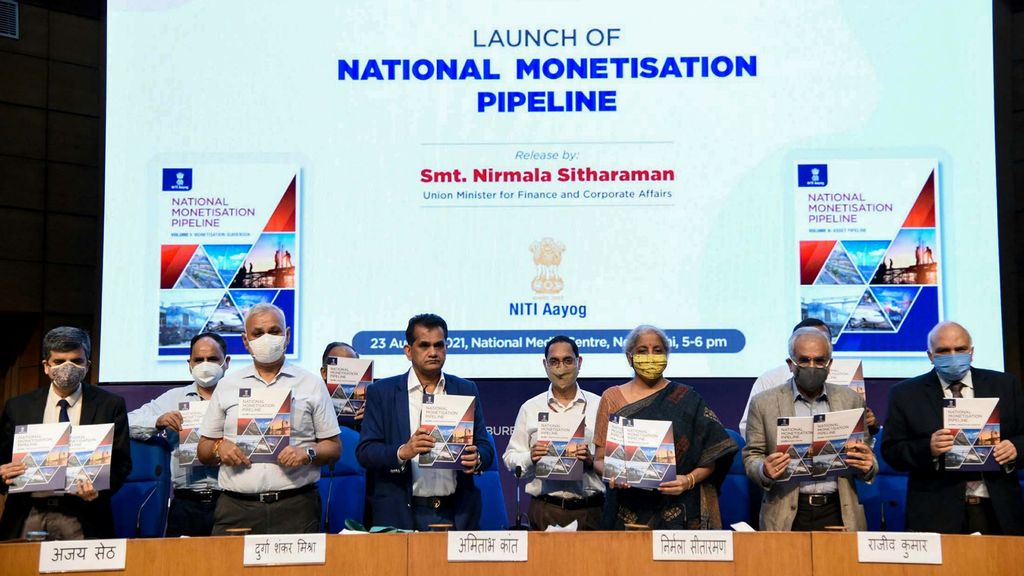

NEW DELHI — India’s Finance Ministry on Aug. 23 launched a National Monetisation Pipeline that includes the central government’s four-year plan to monetize its brownfield infrastructure assets.

The government has planned an INR 6 trillion ($13.4 billion) pipeline of assets that can be monetized — including a range of assets put on the block for private sector participation — over a four-year period, from the fiscal year 2022 to the fiscal year 2025.

“National Monetisation Pipeline talks about brownfield assets where investment is already being made, where there are assets either languishing or not fully monetized or under-utilized,” said Nirmala Sitharaman, Union Minister of Finance.

“Asset monetization — based on the philosophy of creation through monetization—is aimed at tapping private sector investment for new infrastructure creation. This is necessary for creating employment opportunities, thereby enabling high economic growth and seamlessly integrating the rural and semi-urban areas for overall public welfare.”

The Finance Minister enumerated the reforms and initiatives undertaken by the current government towards accelerated infrastructure development and for incentivizing private sector investments.

“At this point, the list of assets that are coming are all the central government’s assets,” she said. “We are not talking about states.”

Rajiv Kumar, Vice-Chairman, National Institution for Transforming India (NITI Aayog), highlighted the program’s strategic objective.

“It will (work) to unlock the value of investments in brownfield public sector assets by tapping institutional and long-term patient capital, which can thereafter be leveraged for further public investments,” he said.

He emphasized the modality of such unlocking, which is anticipated by way of structured contractual partnership against privatization or slump sale of assets.

Public policy think tank NITI Aayog chief executive Amitabh Kant said that the policy is envisaged to serve as a medium-term roadmap for identifying potential monetization-ready projects across various infrastructure sectors.

“The National Monetisation Pipeline aims to create a systematic and transparent mechanism for public authorities to monitor the performance of the initiative and for investors to plan their future activities,” he said.

“Monetization needs to be viewed not just as a funding mechanism, but as an overall paradigm shift in infrastructure operations, augmentation and maintenance considering private sector’s resource efficiencies and its ability to dynamically adapt to the evolving global and economic reality.”

“New models like Infrastructure Investment Trusts and Real Estate Investment Trusts will enable not just financial and strategic investors but also common people to participate in this asset class, thereby opening new avenues for investment. Hence, I consider the National Monetisation Pipeline to be a critical step towards making India’s infrastructure truly world-class.”

As part of a multi-layer institutional mechanism for overall implementation and monitoring of the asset monetization program, an empowered Core Group of Secretaries on Asset Monetization (CGAM) under the chairmanship of Cabinet Secretary has been constituted.

The government aims to make the program a value-accretive proposition for both the public and private investors/developers through improved infrastructure quality and operations and maintenance. This aims to achieve the broader and longer-term vision of “inclusiveness and empowerment of common citizens through best in class infrastructure”.

(With inputs from ANI)

Edited by Amrita Das and Krishna Kakani

The post India Announces National Monetization Pipeline Scheme, $13.4 Billion Assets For Sale appeared first on Zenger News.