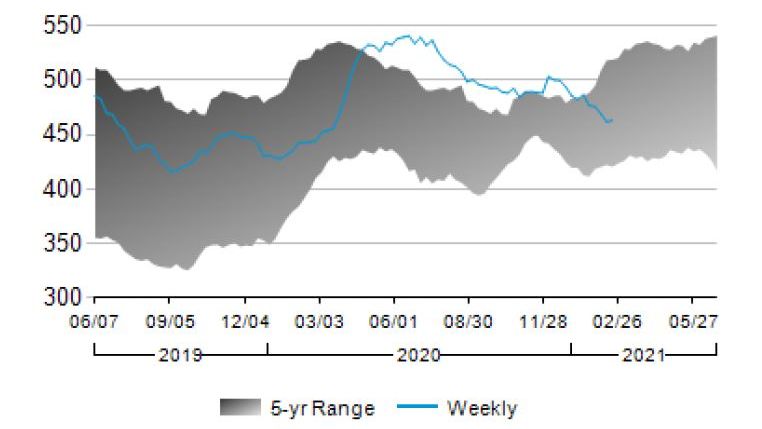

U.S. data on commercial crude oil and petroleum product inventories show the deep freeze in Texas may have left permanent scars, though crude oil prices are still industry supportive, analysts said.The Energy Information Administration, part of the Energy Department, reported that total U.S. commercial crude oil inventories increased by 1.3 million barrels for the week ending Feb. 19. That’s nearly triple the increase reported for the same time last year, though inventories remain within the five-year average.

Traders and analysts pay close attention to the federal energy data for clues about the health of the economy. A drain on commercial inventories suggests demand is healthy, while a surplus is indicative of a waning market appetite.

Phil Flynn, an analyst at The Price Futures Group in Chicago, told Zenger News the data were skewed by the freezing weather conditions in Texas that idled dozens of refineries and sidelined a significant amount of crude oil production.

“There are more concerns that some of this production may not come back,” he said.

Total U.S. crude oil production during the week ending Feb. 19 averaged 9.7 million barrels per day, a 10 percent decline from the previous week and 25 percent lower than the same period last year.

As evidenced by the voluntary restraint from the production group Organization of the Petroleum Exporting Countries (OPEC) and its allies, a decline in output usually sends crude oil prices higher.

The price for Brent crude oil, the global benchmark for the price of oil, was up nearly 3 percent during the Feb. 24 session to trade at around $66 per barrel.

“Not a report that will or can rattle the current bullish sentiment,” for crude oil prices, said Ole Hanson, the head of commodities strategy at Saxo Bank in Denmark. For that to happen, we’d need to see a broad-based reversal in a market that’s seen steady gains in the Dow and other major stock indices, he added.

The price for Brent crude oil is up a staggering 27 percent on the year.

On the petroleum products side, the federal government reported no change in gasoline levels, though distillates, a refined category that includes diesel, showed a draw of 3.9 million barrels. With last week’s extreme cold, heating fuels also saw an uptick in demand.

“The supportive element of this week’s report is another sharp drop in petroleum inventories driven by oil products such as distillate and propane,” said Giovanni Staunovo, a commodities analyst at Swiss investment bank UBS.

(Edited by Bryan Wilkes and Alex Patrick)

The post Storm-Skewed Data No Match For Rally In Oil Prices appeared first on Zenger News.