WASHINGTON, D.C. — After a stellar year for the U.S. renewable energy industry, Congress is keeping the momentum going by including key tax provisions in legislation now signed into law. They include coronavirus pandemic stimulus funding and government funding.

The new law extends tax incentives for consumers installing solar panels on their homes, but the tax credits for wind power sparked opposition from some legislators who see it as an unreliable alternative energy source versus coal. Former President Donald Trump signed the legislation into law on Dec. 27.

“Over the next few years, we have an opportunity to build a stronger, more reliable, and more equitable American energy economy, and the action Congress is taking today is a helpful down payment,” said Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association.

The law includes the extension of a series of tax credits that industry officials said have helped propel the growth of renewable energy in the U.S., including extending a 26% tax credit for consumers and industries that install solar panels.

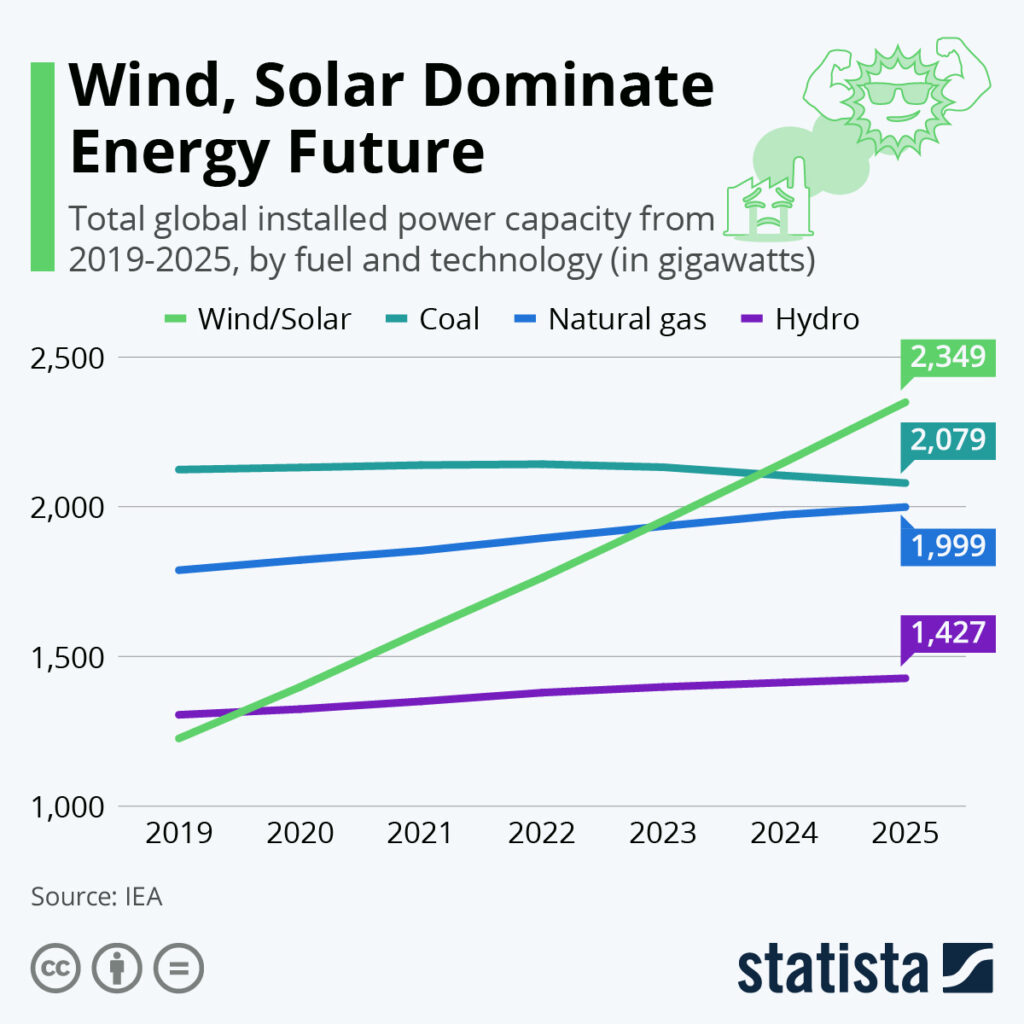

U.S. renewable energy industries reported record-setting years in 2020. Renewable energy capacity is expected to increase by 4% globally in 2020, according to the International Energy Agency’s Renewables 2020 report. Hydropower is expected to continue to produce the majority of renewable electricity, about half, with wind and solar in second and third place.

Last month, the Solar Energy Industries Association released its quarterly report, which projected a record 19 gigawatts of new solar installation across the U.S., a 43% increase from 2019, despite the economic slowdown caused by the coronavirus pandemic.

“This report points to the incredible resilience of our companies and workers in the face of the pandemic and continued demand for clean, affordable electricity sources,” said Hopper. “It also speaks to our ability to support economic growth, even in our darkest moments.

The American Wind Energy Association (AWEA) is also projecting a record-setting year, as its third-quarter report released last fall showed that installation of new wind energy turbines in 2020 were up 72% from the first nine months of 2019. That report also noted the impact federal tax credits have in the growth of the industry.

“Wind developers continue to report difficulty raising tax equity for their projects, as economic uncertainty is restricting the supply of tax equity in the U.S. financial markets,” the AWEA said in a release. Fueled by the federal tax credits, tax equity provides a low-risk financial incentive to drive investments into renewable energy projects.

Renewable-energy officials hailed the inclusion of the tax provisions in the year-end legislation, which extends the wind production tax credit for one year and the solar investment tax credit for two years. The legislation also expands on tax credits for offshore wind projects.

“This bipartisan agreement is a major win for American energy consumers, providing more opportunities for them to receive reliable, zero-carbon, and pollution-free electricity in their local communities,” said Heather Zichal, CEO of the American Clean Power Association.

“We appreciate that Congress has recognized clean energy’s significant contributions to our nation’s economy and role in providing jobs and investments during the recovery from the COVID-19 pandemic,” Zichal said. “As we enter the new year, stable policy support will help ensure that wind and solar can continue providing the backbone of our country’s electricity growth.”

However, there was Republican objection in the U.S. Senate to the wind-power tax credit, which opponents said distorts the energy market.

Sen John Hoeven, R-N.D., one of five to sponsor an amendment stripping the wind tax credits from the year-end legislation, said in a statement that supporting the renewable energy source leads to the loss of other baseload power sources, specifically coal, which could risk blackouts or brownouts.

“We simply can’t afford the loss of power during severe winter weather,” Hoeven stated.

Another senator noted the tax support for renewable energy was supposed to expire and had to be included in crucial budget legislation in order to secure passage.

“The wind production tax credit is harmful legislation and ineffective policy, but once again it was slipped into a must-pass piece of legislation at the end of the year with no debate or discussion. This feels like living in an episode of ‘The Twilight Zone’,” said Sen. Kevin Cramer, R-N.D., in a statement. “Those who continue to slip this credit into these spending bills should consider why it cannot be extended on its own merit and let this market-distorting tax credit expire, as it was supposed to years ago.”

North Dakota is one of the top 10 coal-producing states.

The North Dakota senators said they were able to get similar tax credits for carbon capture and storage technology into the legislation, which is designed to capture carbon emission from coal use before it is emitted into the atmosphere.

“That will enable us to continue utilizing our nation’s abundant coal reserves, while also reducing emissions,” Hoeven said.

(Edited by Bryan Wilkes and Fern Siegel)

The post After Record-Setting Year For Renewable Energy, Tax Incentives Extended appeared first on Zenger News.