MUMBAI, India — India Ratings and Research (Ind-Ra) said on Aug. 24 that the domestic auto sector would continue to face supply chain headwinds, primarily due to semiconductor chips shortages, over the remainder of the fiscal year of 2022.

This is likely to curtail sales growth expected for the auto industry, particularly in the passenger vehicles segment, and adversely impact profitability.

Ind-Ra expects the semiconductor chips shortage to continue until end-1 in the second half of 2022. However, the availability could gradually improve over this period.

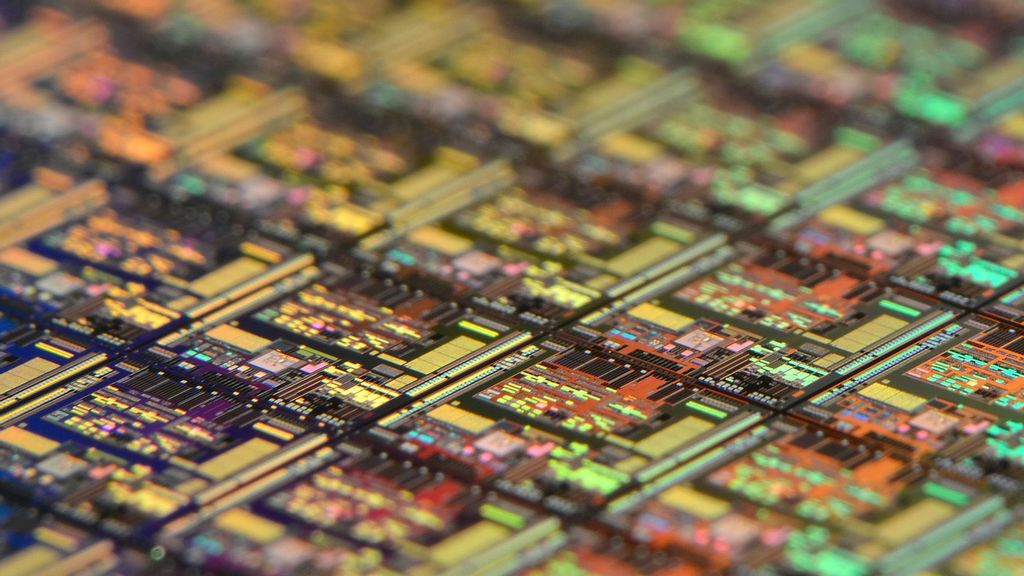

“With the progressive increase in electronic content in vehicles, semiconductors are used in various parts such as automatic headlamps, instrument gauges, parking sensors, anti-lock braking system, and an infotainment system,” senior analyst Pallavi Bhatia said in a statement.

“Typically, these find larger applications in private vehicles than in two-wheelers or commercial vehicles. To mitigate lower availability of semiconductors, OEMs have been prioritizing the use of chips in their more-profitable models, while also developing model variants with fewer accessories that require chips.”

“Private vehicle and original equipment manufacturers such as Maruti Suzuki India Limited, MG Motor India Private Limited, and the Renault Nissan Alliance, among others, have also reduced production and/or taken selective plant shutdowns due to the shortages,” Bhatia said.

It further expects original equipment manufacturers to reassess their supply chains to diversify and/or partially localize their raw material requirements over the near to medium term.

Through the launch of investment schemes, the government has showcased a heightened focus on electronics manufacturing, including semiconductors.

However, as the build-up and ramp-up of semiconductor capacity is a lengthy process, any investments are likely to aid local supply chains only over the medium to long term.

“The global semiconductor capacity has increased by an average of four percent annually in the past two decades,” the agency said.

“Furthermore, Capex growth in the global chip fabrication capacity is expected to be anywhere between 16 percent to 23 percent year-on-year in 2021, as per various research agencies, compared to a CAGR of 6.6 percent over the past decade.”

Ind-Ra said that the demand tailwinds for the passenger vehicle segment remain intact. However, the semiconductor supply scenario is evolving. Hence, the supply-side shortage could affect original equipment manufacturer production volumes, thereby the growth in sales volumes.

Hence, Ind-Ra has revised the expected growth of the private vehicle segment to 15 to 18 percent from 18 to 22 percent for the fiscal year 2022. The chip shortage could affect finished vehicle inventory levels in the next few months and lead to supply-side pressures during the festive season in the third quarter.

Already, the waiting time for some popular models exceeds three months. However, original equipment manufacturers are keeping higher inventory at the dealership level to manage the situation better. The private vehicle inventory at dealers was 30 to 35 days as of end-July.

(With inputs from ANI)

Edited by Saptak Datta and Praveen Pramod Tewari

The post Chip Shortages Can Lower Passenger Vehicle Sales Growth In India: Rating Agency appeared first on Zenger News.