An estimated 9 million borrowers face being kicked out of the program

By Charlene Crowell

A new Department of Education rule redefines eligibility for the popular Public Service Loan Forgiveness Program (PSLF). Instead of focusing on borrower eligibility or payments, the new rule zeroes in on nonprofit employers previously approved for participation.

Only employers that reflect stated White House policies and executive orders will remain in the program. Further, the Secretary of Education is authorized to decide which previously eligible employers can continue in the program, and others who will be dropped.

Caught in the middle of this change are an estimated 9 million borrowers who must wait until July of next year to learn whether their loan payments will lead to forgiveness for the debts incurred while seeking a college education. Under President Joe Biden, over a million borrowers enrolled in PSLF received forgiveness.

Established by the College Cost Reduction and Access Act of 2007 to take effect on October 1st of that year, PSLF forgives remaining loan balances once employees have made 120 monthly payments during full-time employment at any level of government, or tax-exempt, nonprofit organizations identified by the Internal Revenue Code as a Section 501(c)(3). Both community-based services and public interest organizations are among qualified employers.

But on October 31st the new rule was published in the Federal Register, noting that its origin is an earlier Executive Order with the misleading title of Restoring Public Service Loan Forgiveness.

The March 7 order states in part, “[T]he PSLF Program has misdirected tax dollars into activist organizations that not only fail to serve the public interest, but actually harm our national security and American values, sometimes through criminal means…Accordingly, it is the policy of my Administration that individuals employed by organizations whose activities have a substantial illegal purpose shall not be eligible for public service loan forgiveness.”

A recently released Department of Education fact sheet underscores its compliance with that order:

“This final rule does not provide an avenue for borrowers to appeal an employer’s qualifying employer status…On or after July 1, 2026, no payment made by a borrower will be credited as a qualifying PSLF payment for any month that their employer was found to have engaged in illegal activity that rose to the level of substantial illegal purpose.”

“Illegal activities considered by the Secretary include terrorism, trafficking, aiding and abetting illegal discrimination, and certain violations of State law.”

Reactions opposing the new rule were as swift as they were emphatic.

Virginia’s Rep. Bobby Scott, the Ranking Member of the House Education and Workforce Committee, told Inside Higher Ed that the rule “opens the door for all kinds of mischief.”

“If you’re on the Trump side of the partisan political agenda on an issue, you get loan forgiveness. If you’re on the other side of the controversy, you don’t,” he explained. “A group promoting civil rights may be in jeopardy.”

Jaylon Herbin, director of federal policy at the Center for Responsible Lending (CRL), termed the rule as “the latest in a long list of cruel tricks imposed on workers and groups who hold views or serve people this administration doesn’t like.”

“The administration’s attempt to target disfavored viewpoints based on unsupported assertions of groups engaging in illegal activities violates constitutional principles, ignores the will of Congress and unnecessarily politicizes efforts to meet the needs of local communities,” added Herbin.

Earlier this year in a September 17 comment letter to the Department of Education, CRL warned of the ill-advised proposal’s harm.

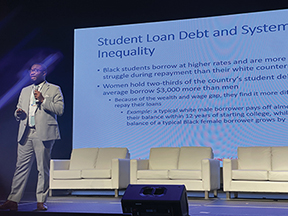

“[T]hese risks are not evenly distributed. Communities already burdened by student debt—including Black and Brown borrowers, women, and first-generation college graduates—stand to be most affected,” wrote CRL. “Ambiguous eligibility rules may discourage nonprofit and government service, reduce access to critical public services, and undermine the civic participation PSLF was designed to encourage.”

“The Department of Education’s final rule unlawfully undermines and politicizes a successful, bipartisan program with a proven track record of helping local nonprofits recruit and retain the workforce they need to provide essential services to the American people,” said Diane Yentel, president and CEO of the National Council of Nonprofits. “Ultimately, the rule will harm the millions of people who rely on their local nonprofits to fill gaps in their communities and help their neighbors.”

Noting how the new rule “would allow the Secretary of Education to disqualify government and nonprofit employers that disagree with the Administration’s right-wing agenda from participating in the PSLF program”, the Student Borrower Protection Center and Democracy Forward issued a joint statement on what the future may hold.

“This new rule is a craven attempt to usurp the legislature’s authority in an unconstitutional power grab aimed at punishing people with political views different than the Administration’s. In our democracy, the president does not have the authority to overrule Congress. That’s why we will soon see the Trump-Vance Administration in court.”

On November 03, staunch opposition to the rule led to two separate lawsuits – both challenging the move as illegal.

Massachusetts Attorney General Andrea Joy Campbell was joined by 21 state attorneys general in the District of Columbia and 20 other states in a lawsuit seeking the rule to be unlawful, vacate it, and bar the Department of Education from enforcing or implementing it.

The same day, a broad coalition of over a dozen cities, labor unions, and nonprofit organizations represented by Democracy Forward and Protect Borrowers filed a lawsuit charging the new eligibility requirements to be unlawful, exceeding the Education Secretary’s authority under the Higher Education Act.